THE amount of money being advanced in the UK for car lease finance doubled in the last five years, to £30.8billion in lease finance in 2015-16, up from £13.4billion in 2010-11, says UHY Hacker Young, the national accountancy group.

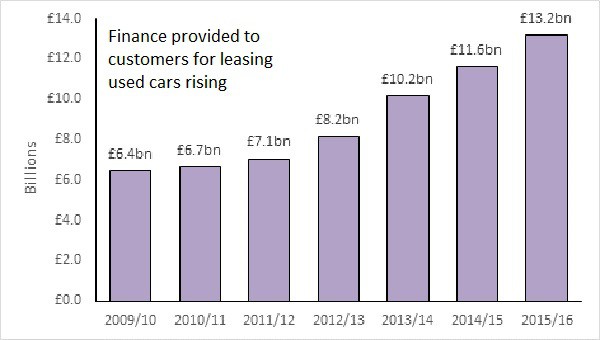

UHY Hacker Young says that the value of new leases provided to customers for new cars has risen 15% since last year – from £15.2 billion to £17.6 billion while the value of new leases for used cars has increased by 13% since last year from £11.6 billion to £13.2 billion.

It says that car ownership is becoming more similar to the mobile phone purchasing model, with customers opting for monthly payment plans based on PCP (Personal Contract Purchase) or PCH (Personal Contract Hire) arrangements.

Once into a monthly payment cycle, the consumer can then be more easily persuaded to upgrade to a new car model rather than being stuck with their original car they bought as an initial outright purchase.

This monthly payment model facilitates more new car sales, as customers no longer have to purchase a car for the duration of its functional life, but can agree frequent upgrades.

Appointed Representative Opportunities with Wessex Fleet

Have you thought about growing your broker business? Are you looking for opportunities for growth? Then why not consider joining Wessex Fleet as an Appointed Representative?

Keeping you on the move with leasing solutions tailored to your needs

Leasys is the proud Contract Hire partner of the Stellantis brands, offering mobility solutions from medium and long-term rentals to management systems for company fleets.We work with Brokers to support all their customers requirements.

Accelerate your business with QV Systems & Leaselink

Unlock unparalleled efficiency in vehicle procurement with QV Systems’ Accelerate, now seamlessly integrated with Ebbon Automotive’s Leaselink. Tailored for brokers and funders, this integration streamlines the entire process from quote to delivery, empowering you to effortlessly source and order vehicles for your clients.

UHY Hacker Young says that the popularity of this model has helped fuel the recovery in car sales post-recession. The provision of point-of-sale finance is increasingly seen by car dealers as a vital tool to unlock sales.

Improvements in the “residual value” of cars have lowered risk for lenders as they can predict with more certainty the resale values of cars that they take back from the consumer.

Residual values remain robust, in part due to a lower number of cars being sold post-recession – keeping supply versus demand in a healthy position.

UHY Hacker Young says that low interest rates have further encouraged the use of car finance to rise, as people are no longer put off by the cost that their borrowing may incur.

Increasing availability of financial products, such as Personal Contract Purchases (PCP), have further attracted customers. PCP involves customers paying for their cars in smaller monthly instalments than in traditional leasing and then deciding later on if they wish to make the final ‘balloon payment’ or to upgrade the model

In the USA, the overall auto-finance market has grown to £1.1 trillion and is now attracting peer-to-peer lenders.

Paul Daly, partner at UHY Hacker Young, says “Lending to customers via the leasing of vehicles has shot up in recent years.

“Monthly payment models have allowed both the new and used car market to recover strongly since the recession as the demand for the latest models has resulted in the higher turnover of cars. Low cost finance will be needed if sales are to remain robust through the period of Brexit uncertainty.”

“New types of leasing plan have been introduced that have helped to make payments more affordable – further enticing more customers to enter into a contract.”

“There is still further opportunity for franchise dealerships to take advantage of this demand for finance as customers gradually convert from the traditional payment model – which is highlighted by growth in the US market.

“Consumers are very receptive to the idea of being able to upgrade to a new car regularly rather than stick with an aging model. Residual value management by the manufacturers will play a key role in ensuring the model is robust and payments remain affordable for the consumers.”