A review by Felipe Munoz, Global Automotive Analyst at JATO Dynamics.

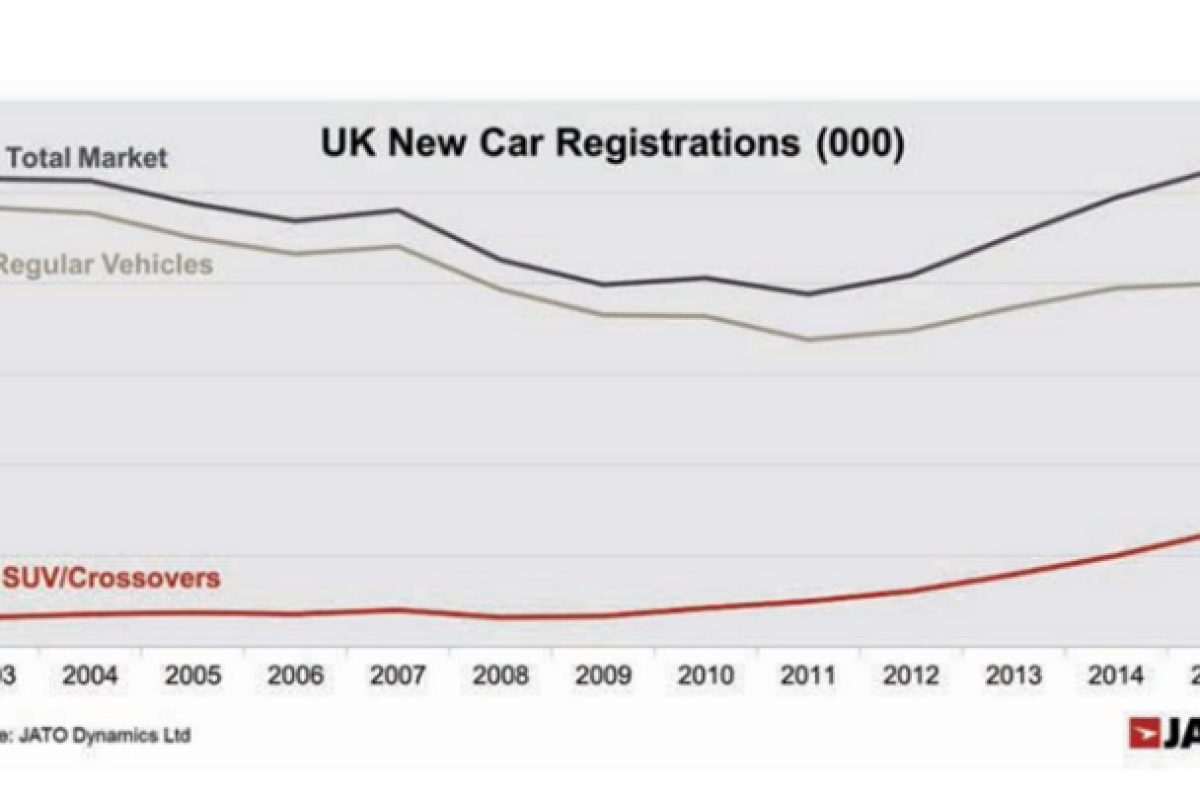

HOW the SUV market features in the UK new car market that achieved its best ever performance in 2015 at 2.63 million units; it was the best result since 2003 and the fourth consecutive year of positive growth that allowed the UK to keep its position as the second largest market in Europe.

Most of the growth is explained by the sales boom of SUV/crossovers that took not only the UK but Europe and many other regions by storm.

For the first time in the history of the British car market, the SUV/crossovers became the best-selling segment outselling the traditional subcompact and compact segments.

Last year SUV registrations accounted for almost 24% of the total, posting an impressive positive growth of 26% over 2014 volumes, totalling 630,400 units.

It was the highest increase among all segments and it was significantly higher than those posted by subcompacts (+4%) and compacts (+3%).

Appointed Representative Opportunities with Wessex Fleet

Have you thought about growing your broker business? Are you looking for opportunities for growth? Then why not consider joining Wessex Fleet as an Appointed Representative?

Keeping you on the move with leasing solutions tailored to your needs

Leasys is the proud Contract Hire partner of the Stellantis brands, offering mobility solutions from medium and long-term rentals to management systems for company fleets.We work with Brokers to support all their customers requirements.

Accelerate your business with QV Systems & Leaselink

Unlock unparalleled efficiency in vehicle procurement with QV Systems’ Accelerate, now seamlessly integrated with Ebbon Automotive’s Leaselink. Tailored for brokers and funders, this integration streamlines the entire process from quote to delivery, empowering you to effortlessly source and order vehicles for your clients.

The evidence shows that it was not a passing trend as annual figures indicate that the SUV registrations have been continuously gaining share since 2008 and driving a big part of the industry’s growth.

Before the results seen in 2015, the last record year was in 2003 when 2.58 million units left the UK’s dealers.

By that year SUV segment counted for 6.2% of the total with only 24 brands and 44 models registering more than one unit sold.

More favourable economic factors such as lower oil prices and the growing appeal of SUV benefits have played a part in the success of the segment and which can also be explained by a wider range of brands, models and even sizes.

During the next three years the total market decreased at an annual average rate of 3% but the SUV segment managed to increase its share up to 7.7% in 2006.

The segment declined during the period 2008-2011 when the total across all vehicle types was short of two million units, but at the same time the SUV registrations continued to grow up to 250,800 units in 2011, commanding a 13% market share.

Their share growth hasn’t stopped since thanks to double-digit percentage growth each year leaving the market for more traditional vehicle types with smaller market share with registrations falling 17% between 2015 and 2003.

More favourable economic factors such as lower oil prices and the growing appeal of SUV benefits have played a part in the success of the segment and which can also be explained by a wider range of brands, models and even sizes.

Last year there were more than 80 models that registered at least one unit sold coming from four sub-segments: the small, compact, midsize and large SUV.

The compacts are the first by volume with 257,500 units in 2015, up by 9% over 2014.

However the small SUV posted the highest volume increase passing from 156,600 units registered in 2014 to 210,900 one year later.

Meanwhile the midsize SUV posted the highest percentage increase (+77%). The consumer has now more choices and many brands are joining the party with updated versions and all-new models.

That’s the case of recently launched Fiat 500X and Ford Ecosport (small), the Renault Kadjar and new Hyundai Tucson (compact), the Land Rover Discovery Sport and Mercedes GLC (midsize), or the new Volvo XC90 and Audi Q7 (large).

SUV market forecast for 2016

According to our forecasting partner LMC Automotive, UK total new car market will remain strong at just over 2.6 million units (+0.4%).

Within this context SUV registrations will continue to grow but at lower rates with total volume reaching 647,000 units, up by 2.7% from 2015 volume.

The segment will benefit from new arrivals such as the new Audi Q1, Bentley Bentayga, Ford Edge, Infiniti QX30, Maserati Levante, the Jaguar F-Pace and a new compact SUV from Seat.